[ad_1]

Investor satisfaction with “full-service” advisors significantly dipped in 2022, moving in tandem with the stock market, according to an annual survey from J.D. Power. The firm’s head of wealth solutions said the dip symbolized a “systemic problem” within the industry.

The J.D. Power 2023 U.S. Full-Service Investment Advisor Satisfaction Study indicated that investors’ satisfaction dropped 17 points (on a 1,000-point scale) between 2021 and 2022, while the market suffered its worst performance in nearly 15 years, with the S&P 500 down nearly 20%.

Tom Rieman, J.D. Power’s wealth solutions head, said advisor satisfaction continued to mirror market swings, with it being a “systemic problem” that advisors’ value propositions were too strongly tied to their investments’ performance.

“Advisors cannot control the ebbs and flows of the market, but the good ones help their clients plan for their best futures and deliver value in the form of comprehensive advice that should shine through in all market conditions,” he said.

J.D. Power has conducted the annual survey for 21 years, measuring overall investor satisfaction with firms by tracking approval in seven factors, including trust, people, products and services, value for fees, wealth management, problem resolutions and digital channels.

Between October 2022 and January 2023, the firm surveyed 6,168 investors working “directly with a dedicated financial advisor or team of advisors,” whose primary relationship was with a full-service wealth management firm. This meant investors with positive or negative reactions to advisors at certain firms were speaking about advisors at those firms, not independent advisors custodying with a larger institution.

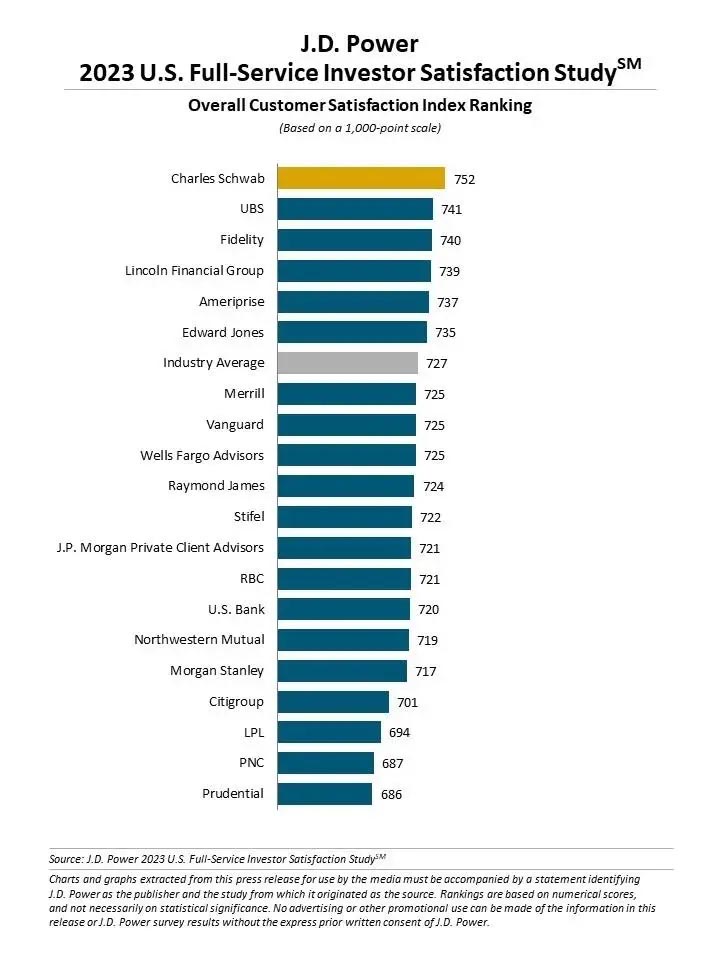

Though the 17-point dip was the largest since 2009, J.D. Power noted the methodology changed several years ago, which makes year-to-year comparisons before 2021 difficult. Since 2021, the average score climbed from 732 to 744 before dropping to 727 this year, according to J.D. Power.

This year, Schwab ranked highest in investor satisfaction at a score of 752, with UBS and Fidelity following behind at 741 and 740, respectively.. Lincoln Financial Group and Ameriprise rounded out the top five, and Prudential, PNC and LPL Financial were the bottom three of the 20 firms listed.

In last year’s rankings, UBS was the highest-ranked firm in overall satisfaction, followed by Vanguard, Schwab (which moved up from No. 10) and Northwestern Mutual.

In the newest study, J.D. Power found millennial and Gen Z clients were most likely to switch firms in the coming year; about 27% of respondents in this age range saying they “definitely” or “probably” will change firms in the next 12 months, while nearly half said they are working with a “secondary investment firm.”

Additionally, J.D. Power found only 57% of “full-service wealth management” clients had a financial plan. The survey also showed that only 11% of advisors were delivering “comprehensive advice,” which J.D. Power defined as personalized guidance that addresses all financial and wealth management needs, while understanding the client’s goals, puts their best interest first, and helps clients understand the fees they pay for the service.

[ad_2]