[ad_1]

Nearly one-third (28%) of financial advisors say they don’t have enough time to spend with their clients, as they become more bogged down with administrative and compliance-related duties, according to the latest J.D. Power U.S. Financial Advisor Satisfaction study, released Wednesday.

The advisors in this category spend an average 41% more time every month than peers on compliance, administrative and other “non-value-added” tasks. The study found net promoter scores—a measure of client loyalty on a scale of -100 to 100—are 27 points lower among employee advisors and 30 points lower among independent advisors who say they don’t have enough time to spend with their clients.

“Right now, many advisors are struggling to find the time to deliver the level of hands-on service they know is critical to growing their business,” Craig Martin, executive managing director and head of wealth and lending intelligence at J.D. Power, said in a statement. “They’re spending more time on administrative and compliance-oriented tasks and, in many cases, they are starting to question whether their firm is committed to providing them with the support and resources they need to succeed.”

At the same time, the J.D. Power survey found that many advisors are eyeing the exits, whether that’s retirement or simply a move to another firm. A fifth of respondents said they are five years or less away from retirement.

In addition, one in three employee advisors and 28% of independent advisors said they “probably will” be working for their current firm in the next one to two years, rather than saying they “definitely will.”

“This suggests that even if advisors are not contemplating leaving the industry or their firm, many may become apathetic about their situation,” the report said. “Among these two groups, overall satisfaction and NPS scores are significantly lower than among advisors who say they are strongly committed to their firms, meaning they could be perceived as hampering efforts to attract and retain talent.”

The study polled 4,183 employee and independent financial advisors between December 2022 and April 2023 to gauge satisfaction among both segments, based on six factors: compensation; firm leadership and culture; operational support; products and marketing; professional development; and technology.

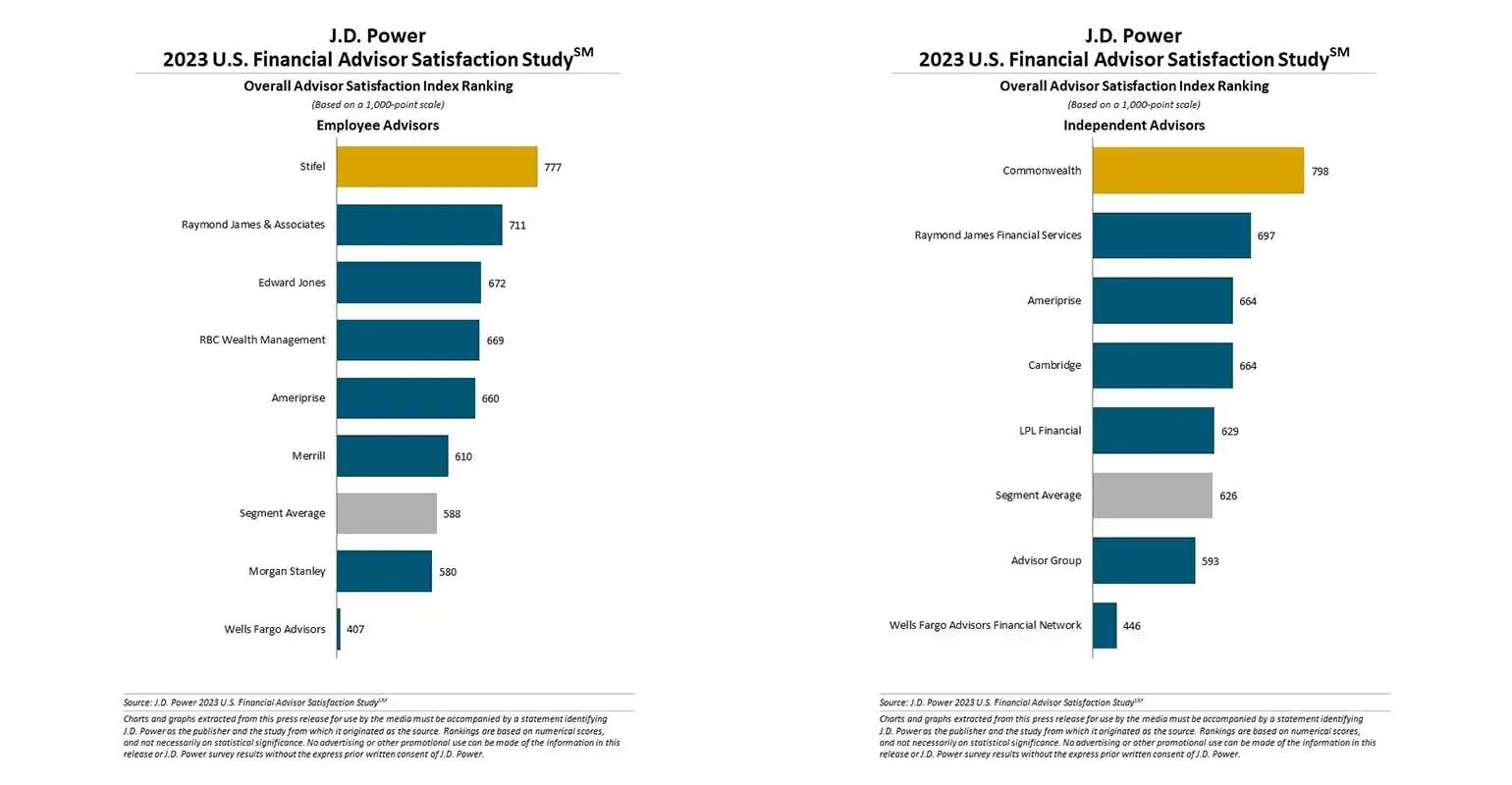

Among employee advisors, Stifel earned the highest ranking with a score of 777 out of 1,000, followed by Raymond James & Associates with 711 and Edward Jones with 672.

Commonwealth Financial Network ranked highest among independent advisors for the 10th year in a row, with a score of 798, followed by Raymond James Financial Services, at 697. Ameriprise tied with Cambridge for third at 664.

Among employee advisors who are most likely to stay with their firm for the long term, the top reasons given for staying are strong firm culture and leadership. Other key factors include professional development support, training and technology.

Zach LaBroad, a financial advisor at SageSpring Wealth Partners, a Knoxville, Tenn.-based firm affiliated with Raymond James Financial Services that manages close to $4.3 billion in assets for more than 10,000 clients, said the 2-year mentorship program offered by the firm provided a “low-pressure environment” in which he was able to gain the confidence and skillset necessary to build his own team, which he has been running for two years.

“Outside learning and degrees can only take you so far,” he said. “A commitment to growth and helping others grow and long-term mentorship are deeply rooted firm principles that many others like myself have gravitated towards. Because of everything that SageSpring has poured into me personally and professionally, it is easy to envision myself here for my entire career.”

SageSpring advisors start as W-2 employees under the mentorship program and through their first year as a standalone advisor. After that, they operate on a 1040 basis.

Among the employee advisor segment, overall job satisfaction and NPS scores were found to be “significantly” higher among female advisors, with an average satisfaction score of 637 on a 1,000 point scale and NPS of 59, compared to 578 and 36, respectively, for male employees.

A material difference between genders was not found among independent advisors.

[ad_2]