[ad_1]

Reducing the amount of friction occurring in an investment portfolio is possibly the single simplest way to improve performance, but, surprisingly, it is also one of the least utilized. Listed below is a basic step-by-step process to help minimize some of the frictional forces found in a typical retirement investment portfolio.

Step 1: Reduce Fund Fees

Take a detailed look at fund fees across all investment accounts (brokerage accounts, 401(k)’s, IRAs, etc.) and compare them with lower cost options. Passively managed index funds and ETFs generally deliver almost identical returns in relation to their underlying index, so finding one on the lower-end of the expense spectrum is recommended. For actively managed funds, analyze whether the fund’s performance warrants the higher management fees. In most cases, it does not. Actively managed funds have underperformed relative to their corresponding passive indexes 92.1% of the time since 1991. In addition to underperforming, actively managed funds typically generate greater tax exposure due to higher investment turnover. Morningstar can be an effective resource for fund fee and tax-efficiency analysis.

Step 2: Analyze Advisor Expenses

Examine the fees being charged by your financial advisor. Advisory expenses have come down considerably with many now charging as low as 50 basis points (0.5%) on assets under management (AUM) as well as others billing on an annual flat-fee basis. If paying around 1% or greater, you should assess the value being provided by your current advisor and possibly try to negotiate a lower rate, a flat fee or simply look for an alternative. Recent growth in fintech and robo-advisory firms has added a wide variety of lower-cost options to the marketplace.

Step 3: Limit Tax Exposure

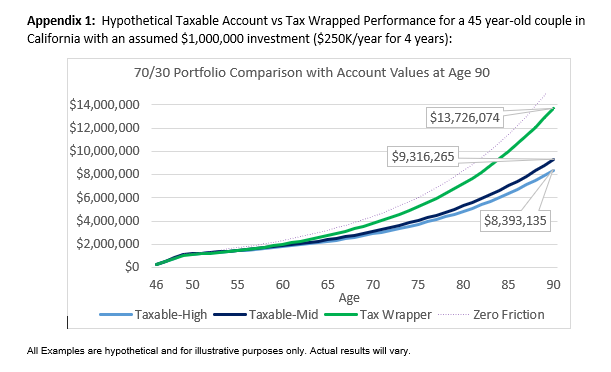

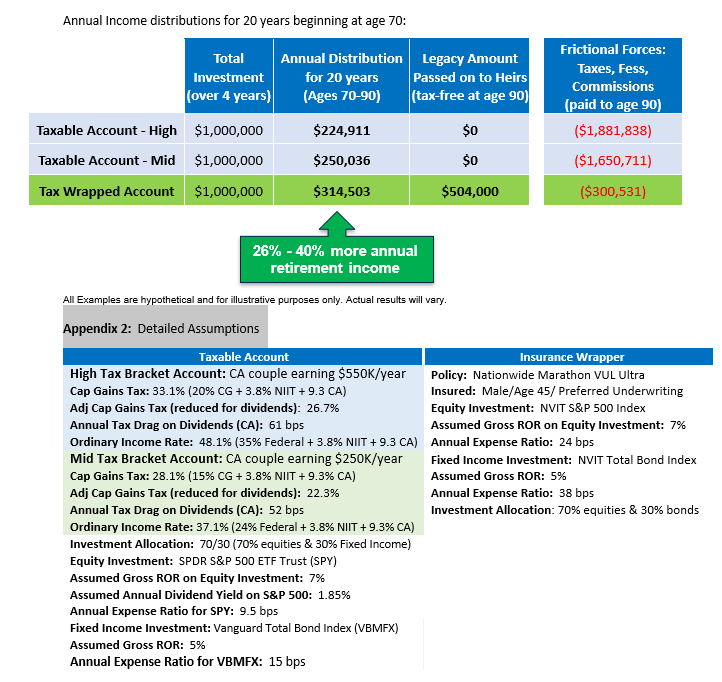

Divide investable assets into three duration-based silos: (1) short-to-mid-term, (2) mid-to-long-term, and (3) long-term only. The long-term portion should be intended for retirement spending and legacy assets that may potentially be passed down to the next generation. For the long-term silo, compare a traditional taxable account with an identical investment allocation placed inside a tax-free insurance wrapper. When designed properly, the insurance protected portfolio can effectively reduce tax friction and outperform the taxable equivalent by a considerable amount. Factors to examine when making this decision include federal/state tax rates and the overall health of the investor. Calculating net results for a taxable equity investment can be somewhat complex because taxes on dividends and capital gains upon liquidation (adjusted for dividends) must both be taken into account. These calculations and detailed comparisons are included below.

Step 4: Assess Results

Compare the net performance of the Zero Friction adjusted portfolio with that of the original one. As a rule of thumb, cutting 50 bps (0.5%) per year in friction over a 30-year investment horizon will generate roughly 15% more income in retirement. Reducing friction by 100 bps (1%) will boost income by ~30%. The main takeaway being that eliminating even small amounts of friction can deliver measurable results when done over longer-term investment periods.

Jason Chalmers is a Director at Cohn Financial Group.

[ad_2]