[ad_1]

Vania Esady, Bradley Speigner and Boromeus Wanengkirtyo

The headline unemployment rate is one of the most widely used indicators of economic slack to measure the state of the business cycle. A large empirical literature on Phillips curve estimation has explored whether more general definitions of labour utilisation are more informative than this simple measure. In a new paper, we investigate whether the duration distribution of unemployment contains useful information for modelling inflation dynamics. More specifically, do short and long-term unemployment (by long-term unemployment we mean individuals who are unemployed for 27 weeks or longer) play separate roles in the Phillips curve?

The literature on Phillips curve estimation tends to suggest that long-term unemployment (LTU) is less inflation-relevant than short-term unemployment (STU). One possible explanation is that labour market attachment declines with unemployment duration and so a higher long-term unemployment share may weaken wage competition. In what follows, we explore the different roles of short and long-term unemployment in shaping inflation behaviour, stressing in particular the interaction between unemployment duration and non-linearity in the Phillips curve.

Simulating a simple Phillips curve

To help illustrate the mechanism, we consider a simple Phillips curve model with two key ingredients: (i) the share of LTU rises in deep recessions and (ii) a slope that is convex with respect to aggregate unemployment. Therefore, by assumption, the effects of a change in STU or LTU on inflation are constrained to be equal at a given level of aggregate unemployment.

Chart 1 shows simulation results from this Phillips curve setup using US data. By design, a convex Phillips curve slope is generated when plotting inflation against aggregate unemployment (left-hand side). However, the interaction of non-linearity with the state-dependence of the LTU share results in an interesting implication: the degree of convexity is exacerbated for LTU (right-hand side) and attenuated for STU (middle).

Our framework offers a straightforward explanation. At the onset of a recession, STU is first to rise and this causes the slope of the Phillips curve to fall. Therefore, by the time that LTU starts to rise, the economy would have already transitioned to a flatter region of the Phillips curve. So LTU’s effect on inflation is likely to be smaller simply by virtue of the fact that it rises after STU, giving the misperception that LTU does not affect inflation very much in recessions. Conversely, however, decreases in LTU are likely to occur when the economy is in a steep region of the Phillips curve, resulting in marked inflationary pressure.

Chart 1: Simulated Phillips curve

Source: Authors’ calculation.

A further econometric investigation

Our next step is to perform a more rigorous statistical analysis. To do so, we adopt an empirical strategy that combines two popular methodologies from the recent literature, enabling us to jointly estimate the curvature of the Phillips curve as well as identify separate slopes for STU and LTU rates. First, we apply a flexible estimation method based on local projections that can easily be adapted to handle rich unemployment dynamics in the presence of state-dependencies in the Phillips curve. Second, we leverage cross-sectional information to further aid Phillips curve identification, making use of state-level rather than aggregate data such as in McLeay and Tenreyro (2019). We construct US state-level unemployment rates by duration from 1994–2017 using the Current Population Survey and merge with the state-level inflation rates constructed by Hazell et al (2022) from US CPI micro-data.

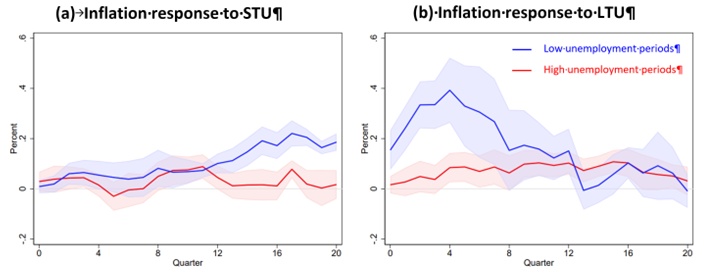

What did we find? The empirical results in Chart 2 mirror the simulation exercise described earlier, showing that the Phillips curve slopes with respect to STU (Chart 2a) and LTU (Chart 2b) diverge most significantly during expansions (blue line) when the labour market is tight, with LTU displaying a larger and more immediate peak effect on inflation than STU. We do not find much of a meaningful difference between LTU and STU during high unemployment periods (red line) when the effect of both unemployment measures on inflation is estimated to be relatively weak. The peak inflationary impact of LTU in the low unemployment regime is around four times higher than when unemployment is high, whereas it is only double for STU.

Chart 2: Response of aggregate inflation to unemployment

Source: Authors’ calculation.

Further discussion and policy implications

What are the possible macroeconomic channels that could explain our findings? We offer two tentative ideas.

First, to the extent that the LTU are relatively more detached from the labour market (Krueger et al (2014)), the search and matching process is likely to be more difficult and less efficient than for the STU pool, effectively making hiring more costly for firms. If such recruitment difficulties are met with higher wage offers by firms, then this would add to inflationary pressure. However, there are various measurement issues with the data that may mean that job finding rates of the LTU are not very different to the STU (Abraham (2014), page 281).

There is also a different demand-side channel that could provide an underpinning for why LTU is an important barometer of inflationary pressure. Becoming unemployed is typically a negative income shock and household consumption responds accordingly. Literature shows that consumption responds more strongly the more persistent the shock is (Jappelli and Pistaferri (2010)). The longer individuals remain unemployed, the more likely they are to perceive the income shock as more persistent, implying that a reduction in LTU may be associated with a relatively large adjustment in aggregate demand.

Regardless of the underlying explanation, from a purely statistical perspective, our results demonstrate that splitting aggregate unemployment into different duration categories in Phillips curve models can help practitioners do a better job of explaining inflation dynamics. The question we have looked into is important in the context of the large fluctuations in the long-term share of total unemployment that has occurred during the downturns following the 2008 recession and the more recent pandemic. Policymakers and econometricians stand to gain from including long-term unemployment as part of the inflation-relevant measure of economic slack, particularly when labour markets are tight.

Vania Esady works in the Bank’s Current Economic Conditions Division and Bradley Speigner and Boromeus Wanengkirtyo work in the Bank’s Structural Economics Division.

If you want to get in touch, please email us at bankunderground@bankofengland.co.uk or leave a comment below.

Comments will only appear once approved by a moderator, and are only published where a full name is supplied. Bank Underground is a blog for Bank of England staff to share views that challenge – or support – prevailing policy orthodoxies. The views expressed here are those of the authors, and are not necessarily those of the Bank of England, or its policy committees.

Share the post “Does long-term unemployment affect inflation dynamics?”

[ad_2]