[ad_1]

While environmental, social and governance investing continues to increase in popularity, important questions remain about its practical significance.

1. Has the trend impacted corporate behavior?

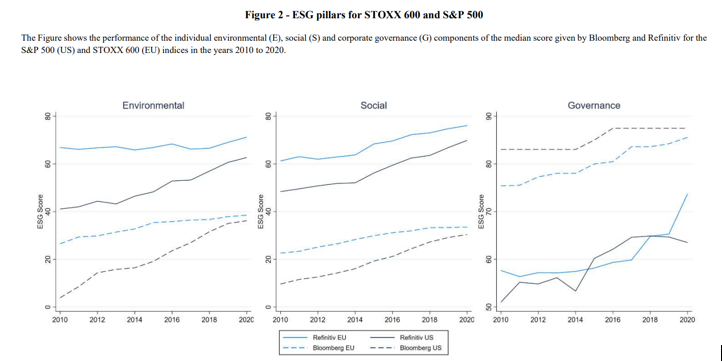

Giulio Anselmi and Giovanni Petrella, authors of the September 2022 study “ESG Ratings: Disagreement Across Providers and Effects on Stock Returns,” examined the ESG ratings assigned by two providers—Refinitiv and Bloomberg—to companies listed in Europe (STOXX Europe 600 Index) and the U.S. (S&P 500 Index) from 2010-2020. They found that median scores increased significantly in recent years for both European and U.S. companies.

Sustainable investors are causing companies to focus on improving their ESG scores to either gain a competitive advantage or avoid being disadvantaged—there is greater corporate awareness of these issues, and awareness is followed by action. That’s good news for sustainable investors, who are not only able to express their values through their investments, but now have evidence that they are causing companies to become better citizens and capitalism to evolve to address sustainability.

2. Do sustainable funds actually support ESG proposals?

Abed El Karim Farroukh, Jarrad Harford and David Shin, authors of the June 2023 study “What Does ESG Investing Mean and Does It Matter Yet?,” examined the voting records of ESG funds on ESG proposals and found:

Voting in favor of costly shareholder environmental and social proposals is still rare—the overwhelming majority of shareholder E&S proposals received minimal support. In fact, the majority of funds did not vote in favor of approving E&S proposals, resulting in their passage by a mere 3%.

Their findings are consistent with those of the authors of the 2023 study “Conflicting Objectives of ESG Funds: Evidence from Proxy Voting,” who found that active ESG funds were more likely than passive ESG funds to vote against E&S proposals. However, investors did not appear to respond to such differential voting patterns by withdrawing capital. The authors stated: “Overall, our results highlight that investors’ conflicting objectives of advancing sustainability while achieving superior returns can impede improvements in corporate sustainability.” Interestingly, these funds were most likely to vote against the E&S proposals when approval rates were close to passing. One explanation was that ESG funds view E&S proposals as expensive, and conceal their preferences for superior returns by voting against them when the proposals were likely to fail. In other words, they are engaged in ‘greenwashing.’

Farroukh, Harford and Shin also sought the answer to questions 3 and 4.

3. Do sustainable funds actively prioritize firms with lower ESG risk when constructing and rebalancing their portfolios?

The impact of ESG on portfolio weights is relatively limited, even in recent years.

While firms that were added to all portfolios tended to have better ESG scores than those that were dropped, the difference in scores between added and dropped firms was not significantly pronounced, even for funds that claimed to prioritize ESG considerations through their names. Funds professing to be ESG-focused did not consistently demonstrate a clear distinction in the ESG scores of the firms they added or dropped from their portfolios, suggesting that if ESG is expressed through portfolio filters, these filters were rarely restrictive or binding.

4. Are there spillover effects within a fund family? Do non-ESG funds within a fund family exhibit an increased propensity to vote favorably for E&S proposals following the family’s introduction of an ESG-focused fund?

The presence of an ESG-by-name fund within a family did not lead to spillover effects. Sibling funds within the same family continued to vote more against, rather than in favor of, E&S proposals.

Their findings led Farroukh, Harford and Shin to conclude that while there has been “a substantial amount of cheap talk about ESG,” there has been “minimal impact on firms in terms of their institutional investor base or the outcomes of shareholder proposals. Despite extensive discourse and numerous studies exploring the indirect effects, such as asset pricing, cost of capital and liquidity resulting from the increasing focus on ESG, it is surprisingly challenging to find concrete evidence of costly actions taken by institutional investors based on their professed commitment to ESG principles.”

Investor Takeaways

There is a growing body of literature on ESG highlighting the potential conflict between investors prioritizing financial returns and those emphasizing ESG considerations. The research demonstrates that this conflict may be exaggerated, with a substantial amount of cheap talk about ESG but minimal impact in the outcomes of shareholder proposals.

Larry Swedroe has authored or co-authored 18 books on investing. His latest is Your Essential Guide to Sustainable Investing. All opinions expressed are solely his opinions and do not reflect the opinions of Buckingham Strategic Wealth or its affiliates. This information is provided for general information purposes only and should not be construed as financial, tax or legal advice. LSR-23-528.

[ad_2]