[ad_1]

Software is enabling better payments execution and increasing the power of merchants

By Rikhil Bajaj, Head of Fintech and Software, Tarsadia Investments

When Adyen’s (AMS: ADYEN) stock price declined over 50% in the week following its Aug 17, 2023 earnings announcement, it was symptomatic of a much deeper problem among incumbent processors. Offering relatively similar products and services, even modern processors are often left to compete on price in a race to the bottom.

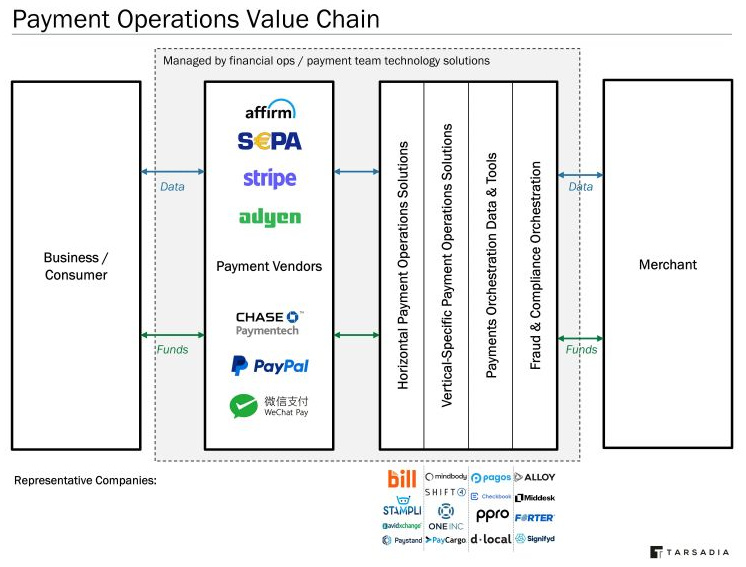

Even worse, processing is becoming less sticky because access to payments vendors is increasingly intermediated by software (“payment operations software”, see below). Payment operations software is necessary because one processor can’t solve today’s complex needs. We live in a world where 74% of volume is marketplace intermediated, 28% is cross-border and card acceptance rates can be as low as 77%.

Tectonic shift from processors to intermediaries

The economics in the payments value chain are set to shift from processors to payment operations intermediaries. Here are five major predictions on how payment operations software will revolutionize the payments ecosystem:

- Payment optimization tools will hold processors accountable: Gone are the days when processors could bury price increases or low transaction conversion in inscrutable monthly reports. Payment data intelligence companies (eg, Tarsadia’s portfolio company Pagos) are equipping merchants with powerful AI and optimization capabilities. It is becoming easier than ever to route transactions between processors based on cost and performance.

- AI/Software will intermediate access to many payment networks: Much ink has been spilled about FedNow, as an example, but it will take years to be ubiquitous since it launched with only 57 of the 8,000 banks and credit unions in the US. Orchestration intermediaries will play a critical role, routing payments intelligently based on speed, conversion and cost across tender types and borders.

- More specialized solutions will serve emerging markets and marketplaces: Latin America and APAC see low card acceptance rates and many local payment methods, so orchestrating payments across processors is a logical way to increase conversion. Orchestration extends beyond simply offering local acquiring services. It also includes performance-aware routing, cost optimization and software integrations. In addition, marketplaces require payment acceptance to be coordinated with payout, including splitting payments, offering escrow, etc.

- Fraud and compliance technology will rapidly re-bundle: Software is necessary to optimize or replace the many tools fraud departments are using. In addition to orchestration platforms, we also see vertically integrated fraud detection engines serving unique markets (eg, emerging markets or digital assets). Particularly exciting are new digital economies (eg, in LATAM or APAC) experiencing 20%-40% growth in fraud solutions markets, given the demand-supply gap.

- Vertical-specific tools will increasingly solve payments execution: There are many examples of verticals that need better software to drive electronic payments growth. Healthcare, insurance, travel and hospitality all face unique issues of multi-party payment flows, complex data collection and reconciliation, and integration with legacy software systems. Even digital industries (eg, software, gaming, digital assets) face high fraud rates and chargebacks.

Underlying these innovations is a powerful call to action for merchants. Why be beholden to your legacy processors when payment operations software can improve performance, reduce costs and help you grow your business? The largest enterprise merchants have strong payments talent supplemented by third-party tools. As the rest of the market follows, multiple hundred-billion-dollar markets will be created in each category.

About the Author

Rikhil Bajaj is the Head of Fintech and Software at Tarsadia Investments, a multibillion-dollar firm that makes high-conviction investments in category-defining companies globally. Previously, Rikhil was at SignalFire, GTCR and Warburg Pincus, where he covered payments extensively.

Recent PaymentsNEXT news:

4 Strategies to accelerate subscription model payments

[ad_2]