[ad_1]

The phrase direct indexing is often used to refer to two quite different things:

- Index generation: creating a custom (sometimes personalized) index.

- Portfolio management: trading so that a portfolio tracks that index over time.

If No.1 is a recipe, No. 2 is following that recipe using (possibly limited) ingredients.

Index Construction

An index is just a set of securities with different weights, often chosen using a process such as market-cap weighting, industry sector restrictions, liquidity, etc. Direct indexing is, or should refer to an instance where a portfolio holds the individual index constituents instead of a fund (ETF, typically) that tracks that index.

There are many ETFs that track well-known indexes. If I make up an index on the fly, no ETFs will track it because (a) it is not getting published, so nobody would know what’s in it, and, more importantly, (b) no ETF Issuer will create an ETF for it if there’s no demand. However, anyone can create their own index and build portfolios that track it. With DI, the lack of tracking ETFs is not a constraint anymore.

Several companies are in the business of creating custom indexes, usually from scratch, but sometimes by modifying an existing index. The construction can also use a client’s personal preferences and/or ESG values.

Portfolio Management

The output of the index construction process becomes an input to the portfolio management process, whose goal is to track that index over time through trading.

In some cases, this is easy:

- If we start with $100,000 in cash, buying all constituents at their index weights will track the index perfectly.

- For the next few days, we may need to do nothing. This is the case for stock indexes denominated in terms of fixed shares (almost all, to the author’s knowledge), where price movement cannot cause the portfolio to become unbalanced.

However, things can get complicated quickly. Examples:

- Cash proceeds from selling a removed stock can’t be invested to yield a “perfect” portfolio if some stocks have buying restrictions (e.g. to avoid a wash sale).

- What if a stock’s ESG score drops? Selling it will improve the portfolio’s ESG score, but may realize tax. It’s a trade-off.

- If a custom index is based on a well-known published index, and that index drops or reduces the weight of a stock, the same tradeoff applies.

The main complexity here is evaluating the tradeoffs (tracking, tax, ESG, transaction cost, holding cost, returns expectations, etc.) subject to constraints.

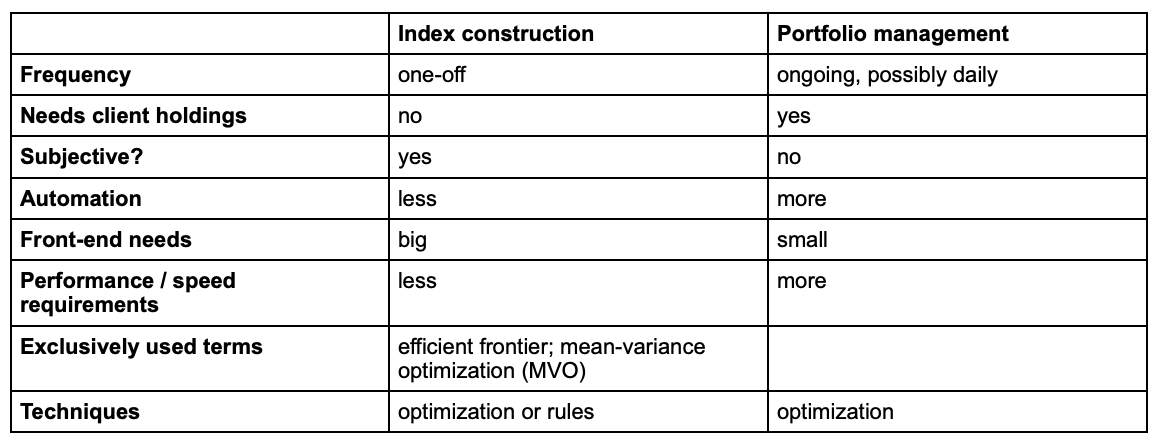

Summary of differences:

Frequency: Robo advisors typically evaluate daily whether a portfolio should trade, even if actual trading only needs to happen every few days. Human advisors may do it quarterly. Either way, custom index construction requires the client’s involvement, and clients will not want to be bothered every few days.

Needs client holdings: In practice, a custom index will not (and should not) incorporate a client’s other holdings. Whether a client already owns e.g. AAPL, the total they should own should be the same. Portfolio management, however, needs to know client holdings so as to “push” towards the best feasible portfolio by buying or selling.

Subjective: Custom index creation incorporates people’s personal values, which is subjective, by definition. Portfolio management is objective. One needs to input many parameters to specify subjective aspects, such as the index to be tracked (regardless of how it was created), or how much a client cares about tracking vs. tax efficiency. However, given such parameters, there is only one best answer.

Automation: Anything subjective cannot be fully automated, since human involvement is needed.

Front-end needs: Some human (advisor, or possibly investor) needs to try out different values and inspect results: e.g. if all stocks with an ESG score of 6 or less are excluded, will there be too few stocks left? Conversely, although a human can inspect the order suggestions of a portfolio management system, that’s not always necessary; the orders can just be sent for execution. This is the case with robo-advisors.

Performance / speed: If index construction takes 0.1 or 1 second after a button is clicked, no human will notice. However, if hundreds of thousands of accounts are evaluated for trading every day, this difference will add up.

Techniques: optimization can be summarized as “minimize something subject to constraints”. The math and software complexity comes from juggling competing goals. Index construction may involve such constraints (e.g. no more than 20% in any industry sector), but does not have to involve minimization. I can construct a custom index simply by taking the S&P 500, underweighting the three stocks I dislike, and normalizing all weights to add up to 100%.

In summary, direct indexing involves a sequence of (at least) two distinct logical steps. We hope this article clarified this difference.

Iraklis Kourtidis is the founder and CEO of Rowboat Advisors, which builds investing software for separately managed accounts with a focus on tax efficiency and direct indexing. He also built the first fully automated version of direct indexing in 2013 for automated investment service Wealthfront.

[ad_2]