Prime Minister Modi Introduced 75 Digital Banking Units - All You Need To Know

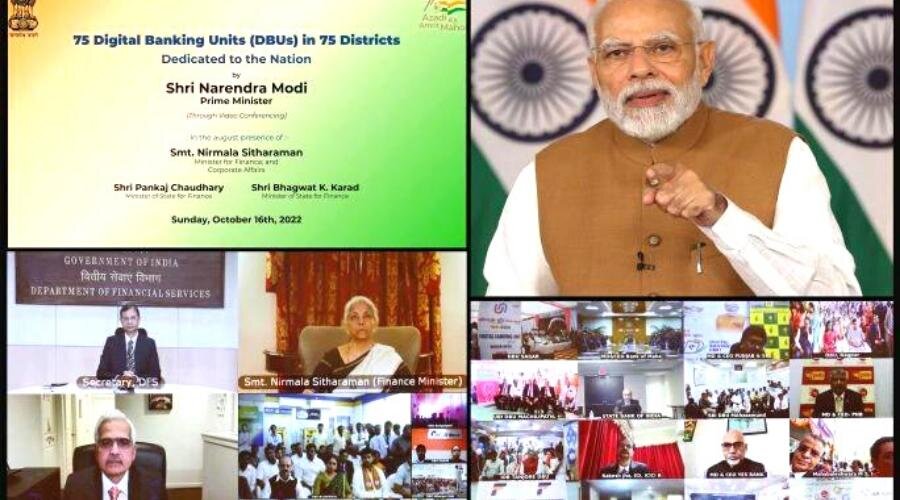

PM Modi dedicated 75 Digital Banking Units (DBUs) across 75 districts on October 16th to encourage financial inclusion.

Finance Minister Nirmala Sitharaman and Reserve Bank of India (RBI) Governor Shaktikanta Das reportedly attended the virtual inaugural event.

“As our nation witnesses the achievement of another digital milestone today, I salute our citizens on their collaborative efforts,” PM stated in his address.”

“This Digital Banking unit will boost digital services and equip the country with a robust digital banking infrastructure, he added.

He said that DBUs would enhance banking and financial management and promote transparency and financial inclusion.

Prime Minister believes that fintech would revolutionize the country’s financial literacy.

The establishment of the 75 DBUs in the 75 districts of the nation was announced by the finance minister as part of the Union budget address for 2022–2023 to mark the 75th anniversary of our nation’s independence.

To provide customers with cost-effective/convenient access and an improved online experience to/of such products and services in a practical, paperless, secured, and connected environment, DBUs are highly specialized fixed point business units or hubs housing specific minimum digital infrastructure for providing digital banking products & services as well as servicing current financial products & services digitally, in both self-service and assisted mode. The majority of services are in the form of self-service.

The DBUs are being established to ensure that the benefits of digital banking reach every little corner of the country. According to a PMO statement, it will encompass all states and union territories.

Also Read,

RBI Calls On Local Banks Not To Increase Their Positions In The NDF Market

Here’s everything you need to know

According to officials, two of the 75 digital banking units (DBUs) being dedicated today are from Jammu and Kashmir Bank.

The two are the SSI branches at Lal Chowk in Srinagar and the Channi Rama branch in Jammu.

Eleven public sector banks, twelve private sector banks, and one small financing bank are participating in the venture.

DBUs will be physical locations that offer a variety of digital banking services such as opening savings accounts, checking balances, printing passbooks, transferring funds, investing in fixed deposits, loan applications, stop-payment instructions for cheques issued, applying for credit/debit cards, viewing account statements, paying taxes, paying bills, and making payments.

According to the PMO, DBUs would provide clients with cost-effective, easy accessibility and an increased digital experience of banking products and services throughout the year.

They will promote Digital Financial Literacy, focusing on client education on cyber security knowledge and precautions.

There would be suitable digital processes to provide real-time help and remedy consumer issues emerging from DBUs’ direct or indirect business and service offerings.

The RBI issued guidelines on the “Establishment of Digital Banking Units (DBUs)” in April of this year.

Also Read,

India’s Central Bank Raise Rate By 50 Bps While Cautioning Of Widening Price Pressures