[ad_1]

Investment strategy should be based on three core principles.

The first is that a strategy should be based on the findings from empirical research, not opinions. The empirical research, including such studies as the 2010 paper Luck versus Skill in the Cross-Section of Mutual Fund Returns, the 2012 study Conviction in Equity Investing and the 2016 study Mutual Fund Performance through a Five-Factor Lens, has found that only 2% of active managers were able to generate statistically significant alpha, and there was no evidence of persistence of outperformance beyond the randomly expected. Combined with the evidence in S&P’s annual SPIVA Scorecards, the logical conclusion is that while it’s possible to beat the markets through active management (stock picking and/or market timing), the markets are highly (though not perfectly) efficient. Thus, the strategy that is most likely to succeed is avoiding active management and using only strategies that are relatively low cost, systematic, transparent and replicable.

The second core principle logically follows: If you believe that markets are highly efficient, you should also believe that all unique sources of risk have similar risk-adjusted returns—acknowledging that risk is not just about volatility but also about whether return distributions have fat tails (investors prefer assets with long right tails and dislike those with long left tails) and whether assets are illiquid (investors demand a premium for accepting the risk of illiquid assets). The reason is simple: If asset A has higher risk-adjusted returns than asset B, cash will flow from A to B until an equilibrium is reached.

The third core principle springs from the second: If all unique sources of risk have similar risk-adjusted returns, then portfolios should be diversified across as many unique/independent sources of risk and return as can be identified that meet all the investment criteria Andrew Berkin and I established in our book Your Complete Guide to Factor-Based Investing. Risk assets should have a premium that is:

Persistent—It holds across long periods of time and different economic regimes.

Pervasive—It holds across countries, regions, sectors and even asset classes.

Robust—It holds for various definitions (for example, there is a value premium whether it is measured by price-to-book, earnings, cash flow or sales).

Investable—It holds up not just on paper but also after considering actual implementation issues, such as trading costs.

Intuitive—There are logical risk-based or behavioral-based explanations for its premium and why it should continue to exist.

Having established that portfolios should be highly diversified, we turn to addressing the issue that traditional 60% stock/40% bond portfolios are dominated by a single risk: the market. As the following example (using the concept of a risk budget and “risk points”) demonstrates, a traditional 60/40 portfolio has much more than 60% of its risk in the market factor. That’s because stocks are much riskier (more volatile) than traditional safe bonds (such as Treasury bills).

Hypothetical Portfolio: 60% Stocks/40% Bonds

Equity volatility: 20%

Bond volatility (5-year average maturity): 5%

Equity Risk: 60 x 20 = 1200 risk points

Bond Risk: 40 x 5 = 200 risk points

Total Risk: 1200 + 200 = 1400 risk points

Percentage Equity Risk: 1200/1400 = 86%

Given the premise of market efficiency, many investors seek to diversify their portfolios in order to reduce the dominance of the market risk factor. That leads to heightened interest by investors seeking to harvest other premiums and create more of a risk parity portfolio by investing in factor-based mutual funds and exchange-traded funds (ETFs). Today, there are trillions of dollars invested in such vehicles. The equity factors that attract the most attention from academic research are size, value, momentum and profitability/quality.

Once investors decide to diversify beyond the traditional 60/40 portfolio, adding other unique sources of risk, they must decide on how to do so effectively. Fortunately, there is a relatively simple answer, as the research, including the 2009 study Optimal Versus Naive Diversification: How Inefficient is the 1/N Portfolio Strategy?, the 2021 study How Inefficient is the 1/N Strategy for a Factor Investor? and the 2022 study Combining Factors, has found that 1/N is a very effective allocation strategy and compares favorably with other optimization-based approaches (such as mean variance and minimum variance).

Let’s take a quick look at how investors can easily implement a 1/N-like portfolio. We will use live funds because while strategies have no costs, implementing them does. Thus, to see the costs of implementation, we need to use live funds.

Implementation

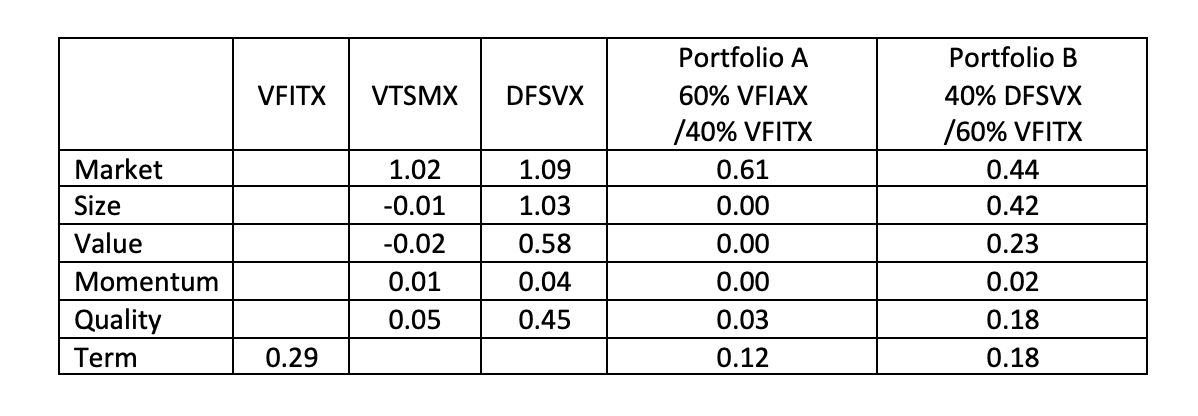

We begin by looking at a traditional 60/40 portfolio using Vanguard’s Total Stock Market Fund (VTSMX) and its Intermediate-Term Treasury Fund (VFITX). We then consider using Dimensional’s U.S. Small Cap Value Fund (DFSVX) instead of VTSMX for our equity exposure, as it has exposures to not only the market factor but also the size, value, momentum and quality factors. The starting point for our analysis is 2013 because that is when Dimensional began to incorporate the profitability factor (which is highly correlated to the quality factor) into its fund construction rules (it began to screen out stocks with negative momentum in 2003). Factor data was available through November 2022.

Using the regression tool at Portfolio Visualizer, we find that Portfolio A has most of the risk concentrated in the market factor. On the other hand, because DFSVX in Portfolio B has exposure to other factors with expected premiums, we can lower our exposure to the market factor while gaining exposure to the size, value and quality factors and increasing our exposure to the term factor. The result is that portfolio B is more diversified across factors—one that is much closer to the 1/N concept and to the risk parity strategy. If an investor wants more exposure to the momentum factor (both cross-sectional and time-series [trend]), there are funds that can provide that exposure. Funds such as AQR’s Style Premia Alternative Fund (QSPRX) are long-short funds that provide exposure to several factors (value, momentum, carry and defensive) across multiple asset classes.

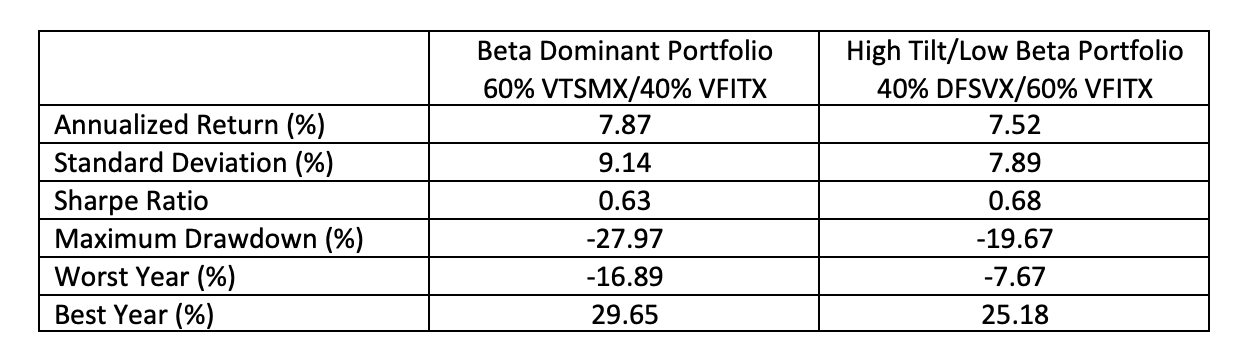

We can now look at the results from two hypothetical portfolios: one that is beta dominant and the other high tilt/low beta. The table below shows the returns, volatility, Sharpe ratio and maximum drawdown of these hypothetical portfolios. We use live funds to make sure we capture implementation costs (which indexes do not include). The period is 1994-2022 (1994 was the inception of DFSVX).

While the returns and volatility of the two portfolios were similar, the high tilt/low beta portfolio produced a higher Sharpe ratio and experienced much lower maximum drawdowns and worst years, while the best years were fairly similar. Over the full 29-year period, diversification across factors was effective. Of course, as is the case with all risk-based strategies, there were periods when Portfolio B provided lower returns and lower Sharpe ratios (for example, when growth stocks outperformed value, specifically during the late 1990s during the dot-com era and during the “dark winter” for value stocks from late 2016 through late 2020).

Importantly for investors in the withdrawal stage of their investment life cycle, the higher Sharpe ratio and the significantly smaller maximum drawdowns and fewer worst years result in lowering the odds of a portfolio running dry. Alternatively, it allows investors to utilize a somewhat higher withdrawal rate without increasing the odds of running out of money.

Having seen how adding other unique sources of equity risk to a traditional portfolio can improve the portfolio’s efficiency and thus the odds of achieving your financial goals, in part 2 diversify beyond the traditional 60/40 portfolio of this series, we’ll tackle how adding other unique sources of risks, in the form of alternatives, can further improve a portfolio’s efficiency.

Larry Swedroe has authored or co-authored 18 books on investing. His latest is “Your Essential Guide to Sustainable Investing.” All opinions expressed are solely his opinions and do not reflect the opinions of Buckingham Strategic Wealth or its affiliates. This information is provided for general information purposes only and should not be construed as financial, tax or legal advice. LSR-23-459

Performance is historical and does not guarantee future results. The performance presented above does not reflect the expenses associated with the management of an actual portfolio. Information may be based on third party data which may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. The availability of data dictates the time frames utilized in the tables above.

[ad_2]