[ad_1]

With the elevated exemption sunsetting at the end of 2025, now’s an ideal time to start planning with high-net-worth clients (commonly general partners in private equity, venture capital or hedge funds) whose compensation includes carried interest. There are many high-impact planning opportunities to consider, but those solutions take time to analyze, set up and execute properly. So, don’t let them wait until the last minute.

In Part 1 of this series, I covered the benefits of gifting carry, the need for a qualified appraisal from a professional familiar with carried interest compensation—and the risk of having a bad appraisal. I also explained the difference between using the option pricing model versus discounted cash flow methods. Now, I’ll expand further on tax saving, gifting and legacy planning opportunities with carried interest derivatives.

Carry presents a special opportunity in light of the elevated exemption sunsetting at the end of 2025. This opportunity is based on the ability of the gift to appreciate due to a combination of risk and time to liquidity. Again, we discussed the benefits of gifting carry in Part 1. Here let’s discuss the challenges with gifting carry (and a solution).

Like any gift, proper execution and documentation of the gift-making process is essential. As mentioned earlier, it’s imperative to have a high-quality appraisal performed by a qualified professional who has experience valuing carried interest compensation. Beyond that, carry is uniquely burdened by several important factors (see below).

The Vertical Slice Rule

As it’s colloquially known, the “vertical slice rule” (Internal Revenue Code Section 2701) governs the gifting of multidimensional interests such as those often owned by general partners (GPs) in private equity funds. This IRC section and its regulations dictate that a transferor must gift proportionate amounts of each layer of their interest. In practice, this eliminates the gifting of strictly carried interest. The easy workaround is to create a safe harbor and to make a proportional gift of the GP’s direct interest (and any other interest). However, the direct interest is significantly less likely to appreciate relative to the carry. Therefore, using the lifetime exemption (or gift tax paid) is much less efficient, and it greatly reduces the effectiveness of this planning technique. Additionally, this strategy would require the transferor to fund the beneficiary with capital so they can pay future capital calls – a highly inefficient planning technique. For more on why it’s problematic, see my recent article, Transferring Business Interests to Optimize Estate Taxes.

Further, limited partnership agreements that dictate the admittance of partners can be cumbersome. Even transfers related to estate planning can be limited and/or very complicated. To avoid tax and funding issues while maximizing the estate planning opportunity, you need a more sophisticated approach.

Carried Interest Derivatives

To resolve the issues discussed above, we need to take get outside the fund structure entirely. The carried interest derivative is a contractual agreement between a GP (transferor) and a trust to pay future carried interest distributions in excess of a hurdle (and can even include a ceiling). These are typically set at-the-money, that is, at the present value of the derivative payments. Additionally, the derivative contracts can include a single (or multiple) payment date. The final payment includes the present value of future expected carry payments.

By using a derivative contract, we’ve addressed the vertical slice rule without making an inefficient gift of direct interest. Additionally, we’ve avoided partnership admittance issues because the trust doesn’t need to become a partner of the GP entity. We’ve even created the potential for a more efficient gift than a carried interest transfer would have yielded (more on that later).

The effectiveness of any derivative contract comes down to the skill of the attorney drafting the document. If you pursue this strategy, then be sure to engage an attorney who regularly practices in this niche. These are highly customizable vehicles that can cater uniquely to a GP’s situation. My colleague, Kevin Brady of New York City-based Wealthspire Advisors, told me recently that the goal is to create a derivative contract that captures the bulk of the fund’s expected gains, but isn’t actually tied to the life of the fund.

This allows us to mitigate the risk of cash flow timing differences between the carry and the derivative. By freeing ourselves from the fund structure, we’ve taken control of timing in a unique way that creates an added ability to create temporary liquidity as long as we structure it properly.

Setting Up a Carried Interest Derivative Sale

As Brady explained, you need to decide who will buy the contract. A trust is often preferable because it provides more control and flexibility. “If you use an intentionally defective grantor trust (IDGT), you can get additional income tax advantages since the grantor (you) pays the income taxes directly,” said Brady. “This allows the trust assets to grow completely tax-free outside of your taxable estate, and the income taxes you pay are not considered gifts or counted against your gift tax exemption,” he added. “If you want to leave the contract to your grandchildren, you also should allocate GST tax exemption to the trust,” Brady recommended.

According to Brady, the next step is to have a third party buy the contract from you, using cash to pay for some or all the carried interest value. “If a new trust buys the contract, you’ll need to fund it with an initial gift to provide liquidity,” explained Brady. “This will require some exemption use, but it should be modest since the contract is worth less than the carried interest itself,” he added.

Finally, at the end of the contract term, if the contract is successful, the trust will pay your client the sum of the distributions they received as well as the present value of future expected carried interest at settlement. “This payment is gift- and generation-skipping transfer tax-free,” asserted Brady. “It allows your client to transfer significant dollars outside of their taxable estate without paying transfer tax,” Brady added. “If the contract fails, you don’t owe the trust anything and you will have used some exemption, but less than you would have used up with a vertical slice gift.”

Real World Example

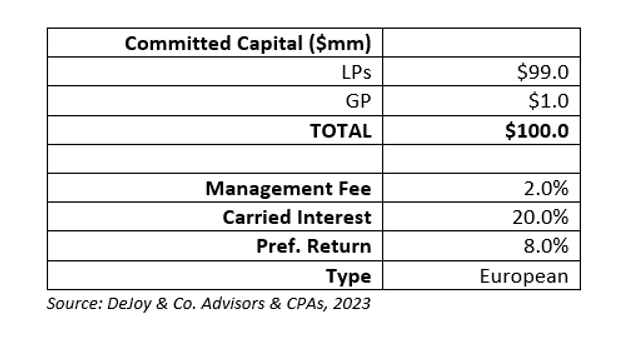

In Part 1 of this article, we discussed the situation of John, a successful private equity fund manager who would like to fund a trust for his young children. John has a GP interest in a newly formed fund (described below).

We determined that the aggregate fair market value (FMV) of a carried interest in the fund is approximately $2 million. Unfortunately, due to the vertical slice rule, John can’t transfer only his carry. He could consider a safe harbor in which he transfers a proportionate amount of his direct interest, but alternatively, he could also consider a derivative contract. Let’s evaluate what that could look like.

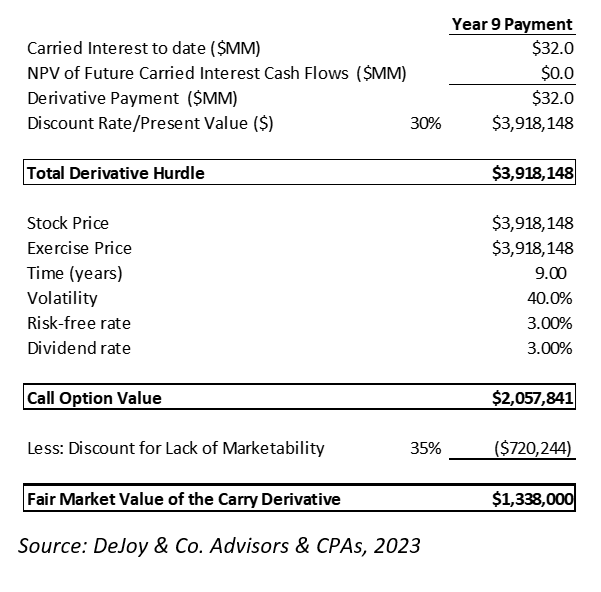

Let’s consider a simple hypothetical derivative contract in which there’s a single payment in Year 8 of the fund and an at-the-money hurdle. Let’s see what the dollar flow would look like:

Even more effective than the carried interest transfer, we conclude a value of about $1.3 million. The FMV is equal to 1.3% of capital, or approximately half of the carry. More importantly, we’ve moved outside the fund/GP structure and addressed the vertical slice rule. John could execute this contract without having to transfer his direct interest or have the trust admitted to the partnership. This represents a simple example of the carried interest derivative, but still leaves many different levers to pull to optimize it for John’s personal goals.

Anthony Venette, CPA/ABV is a Senior Manager, Business Valuation & Advisory, DeJoy & Co., CPAs & Advisors in Rochester, New York. He provides business valuation and advisory services to corporate and individual clients of DeJoy.

[ad_2]