India's Decision To Impose Restrictions On Rice Will Lift Global Prices And Possibly Food Inflation

India’s decision to limit rice exports is anticipated to increase the price of the staple globally and cause rival wheat and corn markets to rally, increasing worries about food inflation.

According to traders and analysts, rice prices are expected to increase in important rice exporters, India, Thailand, Vietnam, and Myanmar, which will hurt food importers who are already paying more for their purchases because of bad weather and the Russia-Ukraine war.

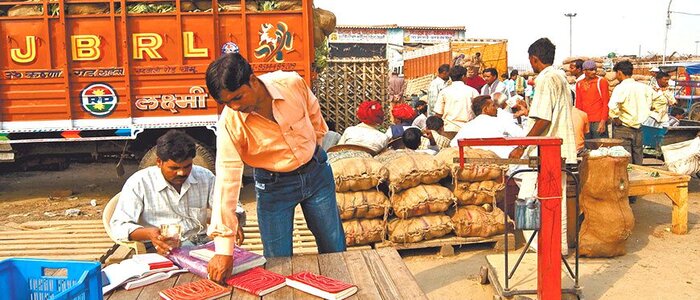

India, the world’s largest grain exporter, tried to increase supplies and stabilize local prices on Thursday after planting was hampered by below-average monsoon rainfall by banning broken rice exports and imposing a 20% duty on exports of various grades of the grain.

“There is going to be substantial stresses on food security across many countries,” said Phin Ziebell, an agribusiness economist at National Australia Bank. “Global fundamentals could see further upside across the grains complex.”

The market was supported by India’s move and talk about Russia’s constraints on Ukrainian grain shipments as Chicago wheat prices increased on Friday, on track for a third straight weekly gain.

“This is an inflationary move for food prices,” said Ole Houe, director of advisory services at agriculture brokerage IKON Commodities in Sydney. “This could trigger a rally in wheat and corn prices.”

About 40% of the total global export market of rice belongs to India, and the country rivals Thailand, Vietnam, Pakistan and Myanmar in this segment globally.

“Myanmar prices should go up by $50 a tonne while suppliers in Thailand and Vietnam will be quoting higher prices,” said one Singapore-based trader.

Also Read,

India’s Tata Group Holding Negotiations With Wistron For A JV To To Assemble iPhones In India

Before India imposed export restrictions, the price of five percent broken rice in Myanmar was quoted at $390 to $395 per tonne, free on board. In India, prices for 5% broken white rice were reported to be around $348 per tonne.

According to Chookiat Ophaswongse, honorary president of the Thai Rice Exporters Association, the decision will impact trade flows because the price of this variety of white rice in India is about $60–$70 per tonne less expensive than in Thailand.

“More orders will flow for Thai and Vietnamese rice,” he said. “We have to wait and see how long this policy from India will go on; if it is longer, it will increase demand for Thai rice exports…”

With higher rice prices, the top two rice importers worldwide, China and the Philippines are likely to suffer immediately.

According to traders, China, one of the largest importers of Indian broken rice for use in animal feed, is anticipated to switch to corn.

“We expect import volumes will decrease with this ban…the new Chinese corn crop is coming to market soon, and there are large volumes of other imported grains,” said Rosa Wang, an analyst at Shanghai JC Intelligence Co Ltd.

“There is news about an alliance of Thailand and Vietnam planning to increase export prices. We are analyzing the possible impact of these possible moves,” Mercedita Sombilla, undersecretary for policy, planning and regulations at the Philippines’ Department of Agriculture, said.

Thailand and Vietnam have decided to work together to raise prices to increase their negotiating power on the international market and increase farmer incomes.

Also Read,

Upcover Introduces New Insurance Payment Options For Sole Proprietors And SMEs