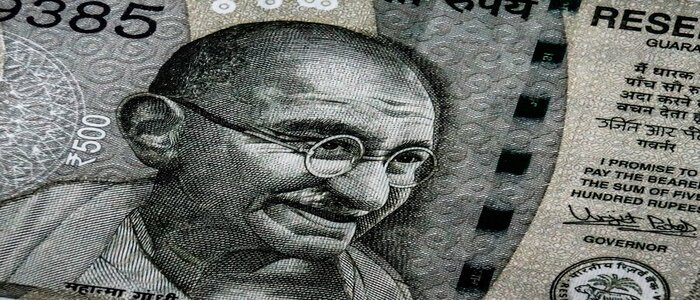

Indian Government's Intervention To Preserve The Rupee Depletes Record Reserves Significantly

India’s action to defend the rupee is eroding foreign exchange reserves at a rate that is on pace to surpass the decline that occurred during unrest a decade ago.

Investors are keeping a close eye on the situation, given the rupee’s collapse to an all-time low last month and the possibility of a widening current account deficit, even though economists and the Reserve Bank of India aren’t yet sounding the alarm.

The reserves are still much healthier than they were during the previous period, which included part of the Eurozone crisis and the Federal Reserve’s taper tantrum. This is because the reserves were steadily built until they reached their peak last year.

During that crisis, the rupee experienced one of the worst performances among emerging-market currencies, falling nearly 30% against the dollar between September 2011 and September 2013. Compared to the US dollar, it decreased by about 6.8% in 2022, a much smaller decline than most of its competitors.

Also Read,

HDFC Capital Advisors Secures More Than INR 500 Cr In 1st Close Of Property Technology Fund

However, the central bank must be aware that, since reaching a peak of $641 billion in September 2021, foreign exchange reserves have fallen by $90 billion, or 13.9%, according to RBI data. The decrease over the previous two years was 14.3%.

“Falling FX reserves, persistently-high commodity prices, limited exchange rate pass-through to inflation, and elevated INR valuations will likely tilt the balance towards a less interventionist FX policy in coming months,” Madhavi Arora, lead economist at Emkay Global Financial Services Ltd., said in a note.

The drawdown has lowered the import cover that these reserves offer to nine months, which is still significantly more than the three months that is the industry standard but far less than the 19 months at the start of 2021.

According to economists at Citigroup Inc, the current account deficit for India is expected to increase from 1.2% of GDP in the previous fiscal year to 3.9% of GDP in the current fiscal year through March. This will likely put pressure on the rupee and increase calls for the RBI to act to lessen the severity of declines.

However, according to Shaktikanta Das, governor of the central bank, the level of reserves and the banking system are both sound and capable of absorbing any incoming shocks.

The RBI has stated that it anticipates the country’s current account deficit to remain within 3% of GDP, which it determines to be sustainable in light of easing the price of fuel, food, and fertilizer globally and improving portfolio flows and exports.

Also Read,

NPCI In Talks With Industry And Government: Market Share Of UPI Players