RBI released the list of D-SIBs (Domestic Systemically Important Banks) in India on 2nd January 2023, and only the State Bank of India, ICICI bank, and HDFC banks remain on the list. No new name has been added to the list. In 2015 and 2016 the Reserve Bank announced the name of SBI and ICICI Bank respectively and on March 31, 2017, HDFC Bank was also classified as a D-SIB, along with SBI and ICICI Bank.

Generally, we forget to realize the importance and responsibility of holding a job in one of the biggest banks in India. Let’s start the story this way:

RBI released the list of D-SIBs (Domestic Systemically Important Banks) in India on 2nd January 2023, and only the State Bank of India, ICICI bank, and HDFC banks remain on the list. No new name has been added to the list. In 2015 and 2016 the Reserve Bank announced the name of SBI and ICICI Bank respectively and on March 31, 2017, HDFC Bank was also classified as a D-SIB, along with SBI and ICICI Bank.

Let’s understand what D-SIB is and its significance in our Economy

D-SIB denotes Domestic Systemically Important Banks meaning the Indian economy is dependent on their fall or rise.

We all know the Banking Industry is the pillar of our Economy and these banks in India are considered as “Too big to Fall”. Although this tagline helps these banks to receive certain advantages like winning the trust of people, funding from the market, established brand value, and government support at crucial times.

But on the other hand, there are certain parameters that are required to be controlled such as it amplifies the risk-taking bucket by management. Sometimes it may be due to pressure from the government, or it may be the demand of a market where the market size is 1.5 billion population in India. Therefore market control is an important factor, otherwise, it can result in economic distress in the country.

Also Read: Japanese Central Bank Becomes More Hawkish As Inflationary Pressures Prevail; Asian Markets Tumble

Birth of BASEL III

We all have witnessed the consequence of the Lehman brothers crisis, and no one wants to revisit that moment. Therefore, a series of reform measures, broadly known as Basel III, were discovered to protect the global economy, to ameliorate the resiliency of banking systems.

According to the report “Basel III: A global regulatory framework for more resilient banks and banking systems” dated June 2011, reform measures include

- Raising the quality, consistency, and transparency of the capital base

- Enhancing risk coverage

- Supplementing the risk-based capital requirement with a leverage ratio

- Reducing procyclicality and promoting countercyclical buffers.

These policy measures are applicable to all banks including SIBs. But, these policy measures are not sufficient to deal with risks taken by SIBs. Therefore, additional policy measures for SIBs are imperative to counter the systemic risks taken by these banks.

History of D-SIBS

Therefore, after the global financial crisis, In October 2010, the Financial Stability Board (FSB) recommended that all member countries develop a framework to reduce risks accountable to Systemically Important Financial Institutions (SIFIs) in their jurisdictions.

The FSB asked the Basel Committee on Banking Supervision (BCBS) to develop an assessment methodology consisting of quantitative and qualitative indicators to evaluate the systemic importance of Global SIFIs (G-SIFIs). They also asked to build an assessment methodology to measure the magnitude of going-concern loss absorbency capital which various proposed instruments could provide. Consequently, BCBS came out with a framework in November 2011 (since updated in July 2013) for identifying the Global Systemically Important Banks (G-SIBs) and the magnitude of additional loss absorbency capital requirements applicable to these G-SIBs.

The G20 leaders had asked the BCBS and FSB in November 2011 to extend the G-SIBs framework to Domestic Systemically Important Banks (D-SIBs) expeditiously. The BCBS finalized its framework for dealing with D-SIBs in October 2012. In this way, RBI took the responsibility to execute the guidelines in Indian Banking Industry and identified three Banks as D-SIBs who are able to maintain the measures.

Also Read: Three Components Of the PSB Index Have Increased By More Than 50% In One Month

BCBS framework for dealing with the D-SIBs and Indicators of D-SIB as per RBI

The D-SIB framework focuses on the impact that the distress or failure of banks will have on the domestic economy. As opposed to the G-SIB framework, the D-SIB framework is based on the assessment conducted by the national authorities, who are best placed to evaluate the impact of failure on the local financial system and the local economy. The D-SIB framework is based on a set of principles, which complement the G-SIB framework. RBI plays the role to evaluate D-SIB in India based on evaluation methodology.

Assessment of D- SIB:

Certain indicators to be used by RBI to assess the domestic systemic importance of the banks are as follows :

- Size,

- interconnectedness,

- substitutability

- and complexity.

Furthermore, RBI has identified a sub-indicator under an indicator of systemic importance and allotted weight accordingly, which is given below:

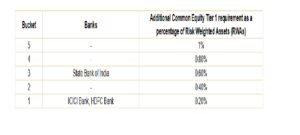

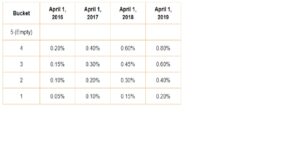

D-SIBs are required to maintain higher capital requirements and RBI must publish a report on the maintenance of Additional capital D-SIBs.

As per the RBI website, The higher capital requirements applicable to D-SIBs have begun to be implemented from April 1, 2016, in a phased manner and became fully effective from April 1, 2019. The phasing-in of additional common equity requirements is as follows:

This is how our banking system is able to maintain a concrete structure which results in a stable banking system in India. We must appreciate the management and other stakeholders in our banking Industry.